Is it worth Amazon’s market cap?

I updated my standalone AWS scenario analysis and valuation model and decided to share it with Implied Expectations subscribers. Since I started IE, I’ve shared screen shots of these models in PDF files within the posts. But some of you have been pretty vocal that you’d like to play around with the scenarios and models yourself. So as a result, I decided to throw my AWS model out into the universe as a sample. Scroll down to the end of this post for the link.

If you’re into this and want to play around with my models, check out my new creatively named research service—Implied Expectations… with Models. It is IE… but, wait for it, with models. It’s intended for a professional investor audience but anyone is welcome of course.

Have a look at the AWS model and see what you think the business might be worth. There is lots of conjecture about whether AWS could be worth Amazon’s entire market cap today, thus making everything else—online retail, including Prime, 3P, FBA, and advertising, physical retail, Kindle, Echo/Alexa, GO stores with JWO technology, Zoox, Project Kuiper, Twitch, MGM, and the list goes—free. Dig into it and see what assumptions you need to make about AWS’s future for that statement to be true.

AWS is a pretty simple business to model because outsiders only have a few key variables to work with—net sales growth, operating margins, and capex. This isn’t one of the complex ones where you can build net sales up from the bottom up based on volumes, ASPs, and other variables across multiple revenue streams that have different margin profiles. Or one of the subscription models that incorporates gross adds and churn. That said, the relative simplicity of this model shouldn’t suggest any easier of a time predicting the future. But it’s inescapable, in my view, that buying a stream of future cash flows for the long term requires us to think thoughtfully about the size and duration of that stream of future cash flows.

I suggest starting in the “AWS Scenario Analysis” tab and playing around with the assumptions. There are five scenarios to work with—the cells in blue are intended to be tweaked as you see fit. Once you’re content with your scenarios, move over to the Valuation Summary worksheet and click the Update Valuation button. This runs a simple macro that toggles through each of the five scenarios, copies the valuation outputs, and pastes them in the right spots on the Valuation Summary worksheet.

My Current Version

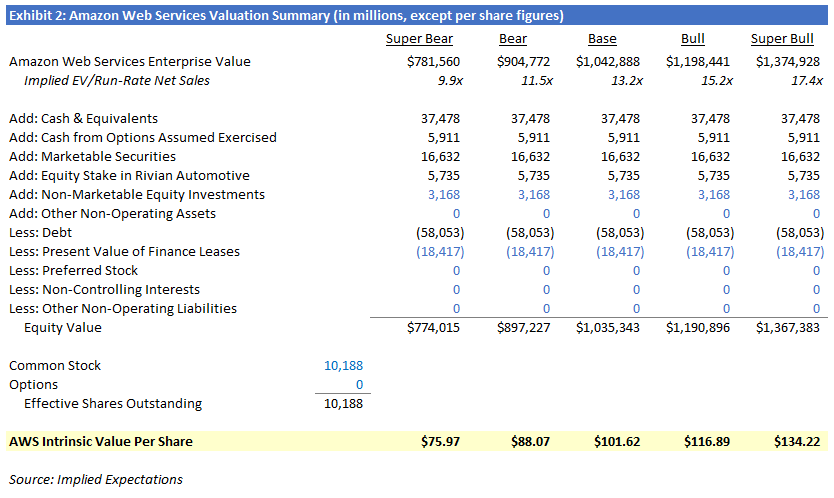

You can see my current version when you open the model, but here it is as well.

Amazon-Web-Services-Scenario-Analysis_2022.10.05

And my valuation summary that brings in the valuations derived from the model:

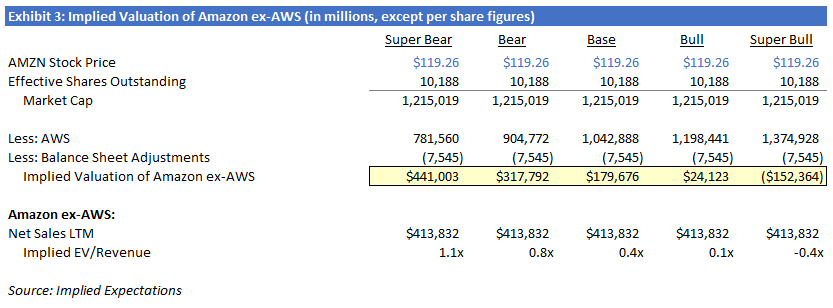

This suggests AWS plus balance sheet adjustments is worth somewhere between $76 and $134 per Amazon share, depending on the scenario. AMZN closed yesterday at $121, suggesting we could be pretty close to the point where Amazon ex-AWS is free or at the very least, very cheap. That said, valuation conclusions are only as good as the assumptions—garbage in, garbage out. It’s up to each investor to decide what might be garbage and what might not be.

[Side note: Long-time readers may notice the Implied EV/Run-rate Net Sales line that I added above. Here, I’m showing it as an output to the valuation process rather than as an input. I prefer that approach because I’m not smart enough to pick multiples out of thin air for rapidly growing businesses when there are so many underlying long-term assumptions around growth/margins/capital intensity/tax rate/discount rate/terminal value.]Given these AWS valuations, what is the market saying Amazon ex-AWS is worth right now?

Of course, this is just one guy’s model at one moment in time. Download it and try it for yourself at the following link:

Implied Expectations Amazon Web Services Scenario Analysis and Valuation Model

When you download it, Excel will probably tell you that you have to disable macros because the file is from an untrusted source. Go ahead and click disable macros. If you want to enable them, save the file somewhere and close it. When you reopen it, you’ll be given the choice to enable them. The macro just makes it fast and easy to import the valuations in each scenario into the Valuation Summary tab. It probably saves you 30 seconds of copying and pasting.

Feel free to post a screenshot of your valuation summary on Twitter and tag me (@longhillroadcap). It would be interesting to see what people come up with.

Here’s the link again to Implied Expectations… with Models. I’ll be posting all my models of companies I’ve written about and new ones. Requests are welcome.

Disclosure: Long AMZN

Disclaimer: This post is for entertainment purposes only and is not a recommendation to buy or sell any security. Everything I write could be completely wrong and the stock I’m writing about could go to $0. Rely entirely on your own research and investment judgement.